Supply & Distribution

Token Supply

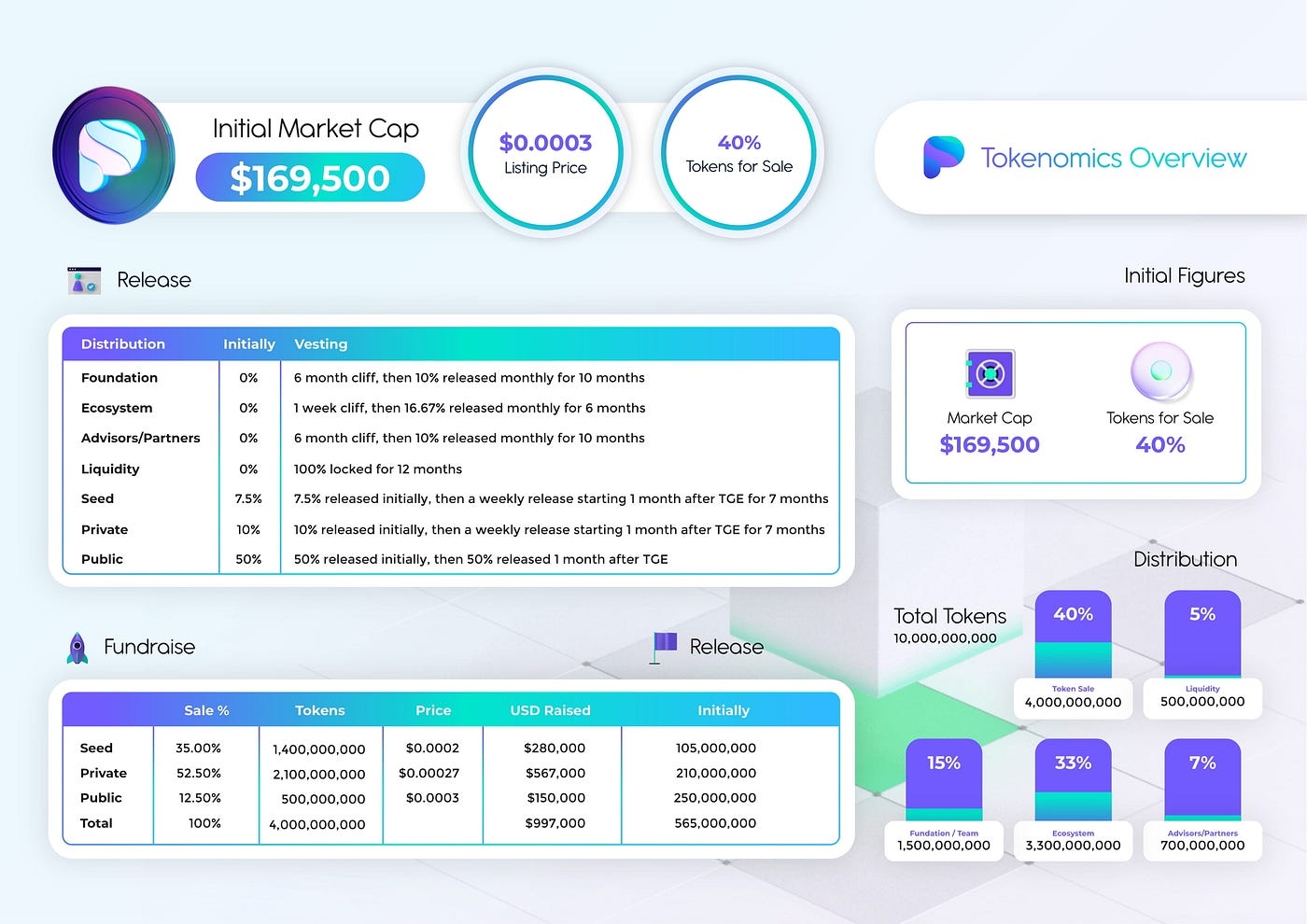

Paribus has a total token supply of 10B PBX and the distribution is as follows:

Total Supply: 10B

Sale In Aggregate: 4B

Ecosystem: 3.3B

Foundation: 1.5B

Strategic/Advisory: 700M

Liquidity Provisioning: 500M

Despite a relatively straight forward distribution, the rationale effectively weighed a number of considerations:

The larger ecosystem is designed to reward and stimulate users. Given more exotic assets have less defined marketplaces, encouraging trading by way of community support is essential.

A sizable sale allows the Paribus team to strategically distribute the token to value add investors as well as the public. The team believes this will ultimately facilitate platform usage.

The remaining is relatively traditional but the team is anticipating platform needs. For example, additional liquidity may be required when going cross chain, while worthy partners, content creators and centralized exchange partners can add considerable value.

Token Sale Distribution

Seed: 1.4B PBX @.0002

Private: 2.1 PBX @.00027

Public: 500M PBX @.0003

While the seed and private rounds ensure that sufficient funding will be made available, the relative price uniformity speaks to the belief in the Paribus project. Typically, there is a multiple levied against the public sale buyers while team PBX was able to attract value-add investors and keep the buy-in price points equitable and fair.

The team feels that ultimately, a wider distribution of PBX will be the driver in sustaining market demand while in the near term, the price parity and value add of strategic backing will secure a smooth rollout.

Vesting

The rate at which tokens are released can impact the market. This is a given. The distribution of PBX has been considered their roadmap to best align distributions with milestones that can create functional demand for PBX.

Foundation: 6 month cliff, then 10% released monthly for 10 months

Ecosystem: 1 week cliff, then 16.67% released monthly for 6 months

Strategic/Advisory: 6 month cliff, then 10% released monthly for 10 months

Liquidity: 100% locked for 12 months

Seed: 7.5% upon TGE, weekly release 1 month after for 7 months

Private:10% upon TGE, weekly release 1 month after TGE for 7 months

Public: 50% released initially, then 50% released 1 month after TGE

In order to create a fairer marketplace, the largest distribution of circulating tokens will come from the public round, with 250M being put “in the wild,” following the IDO.

Additional Numbers:

Circulating Supply Following TGE: 565M PBX

Listing Price: .0003USD

Hard Cap: 997K

Market Cap At TGE (based on public price): 169.5K**

**The market cap at TGE uses the public price vs. a blended average of seed, private and public. Calculating actual price paid and releases across rounds will produce a market cap of 152.7K.

Additionally, it is worth noting that liquidity is not included in this calculation as it is impossible to know how much of that will be tapped. Certainly, we can expect some of the 500M tokens put up to become circulating but can not possibly anticipate an actual number. Furthermore, this liquidity, represented in PBX and pair, is locked for a minimum of 12 months

Last updated